NCAB Group AB (publ) (“NCAB” or the “Company”), a leading supplier of printed circuit boards, today announces the outcome of its Initial Public Offering (the “Offering”) and listing of its shares on Nasdaq Stockholm (the “Listing”). The Offering attracted very strong interest from both Swedish and International institutions as well as the general public in Sweden and employees of NCAB. The offering was heavily oversubscribed.

The Offering in Brief:

- As previously announced, the price per share in the Offering was SEK 75, corresponding to a total value of the outstanding shares in NCAB upon completion of the Offering of SEK 1,264 million

- The Offering comprised 7,274,991 shares of which 1,333,334 shares were issued by the Company and 5,941,657 existing shares were offered by R12 Kapital AB, Gogoy AB (owned by the Company’s chairman of the board), Hans Ståhl (the Company’s CEO) (together the “Principal Shareholders”) and certain other minority shareholders, including certain members of the board of directors and executive management (together the “Selling Shareholders”)

- The number of shares in the Offering was increased, in accordance with the terms of the offering, by 1,641,025 shares (the “Upsize Option”), corresponding to approximately 9.7 percent of the total number of outstanding shares in the Company upon completion of the Offering

- In order to cover potential over-allotment in relation to the Offering, the Principal Shareholders will, upon request from Carnegie Investment Bank AB (publ) (“Carnegie”), undertake to offer up to 1,337,402 additional existing shares (the “Over-Allotment Option”), corresponding to up to 15,0 percent of the number of shares in the Offering

- Assuming the Over-Allotment Option is exercised in full, the value of the Offering will amount to approximately SEK 769 million and correspond to approximately 60.9 percent of the total number of shares in the Company upon completion of the Offering

- The Fourth Swedish National Pension Fund (AP4), the Third Swedish National Pension Fund (AP3), C WorldWide Asset Management, Länsförsäkringar Fund Management and Lazard Asset Management (the “Cornerstone Investors”) have acquired shares in the Offering corresponding to 7.5 percent, 4.0 percent, 3.0 percent, 3.0 percent and 3.0 percent respectively of the outstanding shares in the Company upon completion of the Offering

- Trading in the shares in NCAB on Nasdaq Stockholm commences today, 5 June 2018, under the ticker “NCAB” and settlement will take place on 8 June 2018

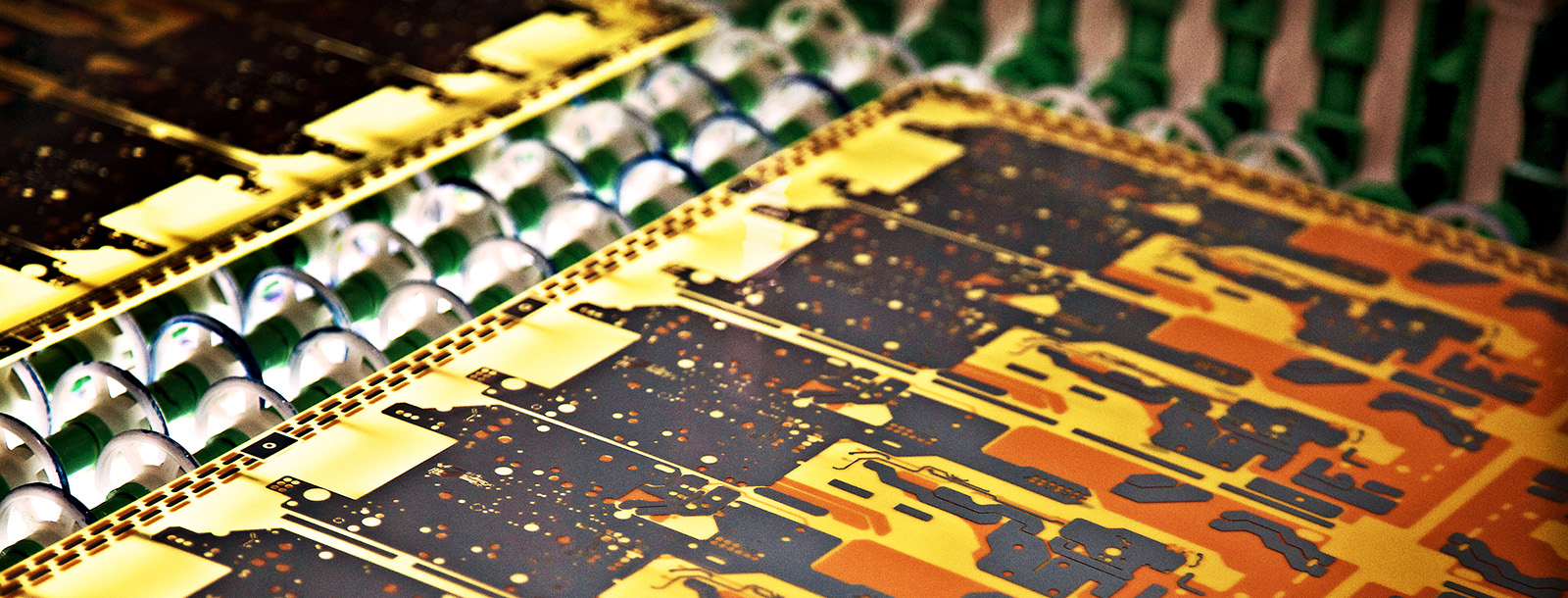

NCAB is a leading supplier of printed circuit boards, taking full supplier responsibility towards its customers and with local factory presence. NCAB was founded in 1993 as a printed circuit boards trading company. Since the Company was founded, the operations have been characterized by an entrepreneurial and cost efficient culture and have over time showed strong growth and good profitability.

NCAB has local presence in 15 countries and customers in approximately 45 countries worldwide. From the financial year 2008-2017, revenues have grown from SEK 374 million to SEK 1,400 million, corresponding to a compound annual growth rate of 16 percent. The increase in revenues has been driven both organically and through acquisitions. Organic growth and acquisitions are part of NCAB’s growth strategy and during the aforementioned period, four companies were acquired and integrated.

As of 31 March 2018, NCAB had 365 employees.

Carnegie acted Sole Global Coordinator and Bookrunner in the IPO