Carnegie är nordens ledande investment bank med cirka 180 medarbetare som tillsammans täcker den nordiska regionen. Vi har en stark position inom ECM och är den tydliga ledaren inom nordiska börsintroduktioner. Dessutom har vi den starkaste positionen inom M&A med det största och mest erfarna teamet i den nordiska regionen.

Vår rådgivning

Investment Banking erbjuder kvalificerad rådgivning inom samgåenden och förvärv (M&A) och aktiemarknadstransaktioner (ECM). Inom området företagsobligationer (DCM) erbjuds också rådgivning kring kapitalanskaffning via företags-obligationer och ränteinstrument.

Våra branscher

Förutom Carnegies omfattande transaktionserfarenhet finns en djup förståelse för olika branscher. Vi samarbetar med ett brett spektrum av kunder, såsom entreprenörer, familjeägda bolag, statliga organisationer och private equity-bolag.

Penser By Carnegie

Penser by Carnegie erbjuder specialiserade tjänster inom aktiemarknadstransaktioner, kapitalanskaffningar och företagsöverlåtelser. Vi fokuserar på att stödja mindre bolag och har en imponerande historik av framgångsrik rådgivning under expansionsfasen.

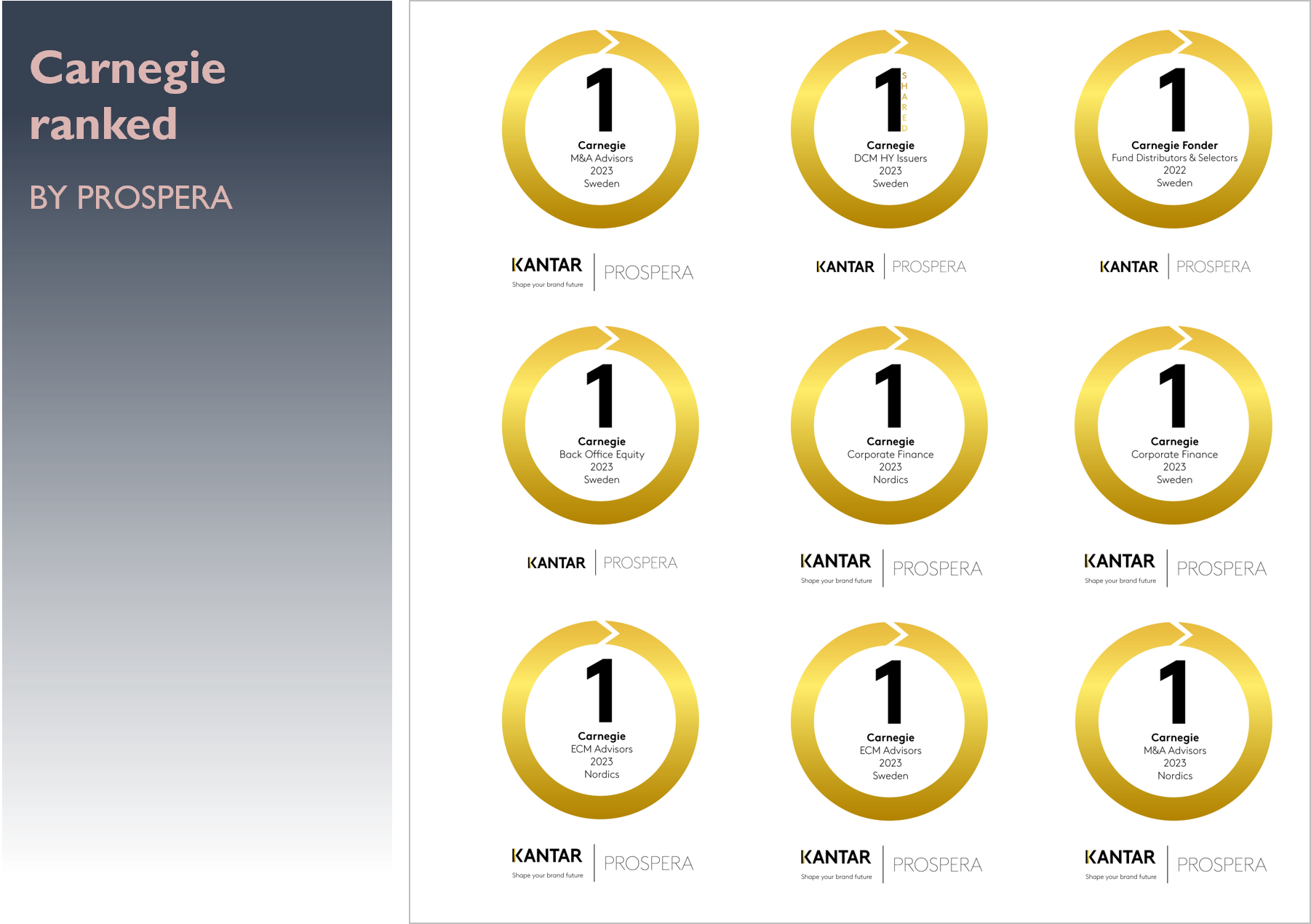

Carnegie har under de senaste åren utmärkt sig som den ledande aktören inom Corporate Finance. I oberoende kundundersökningar så som Kantar Sifo Prospera vinner Carnegie inom kategorierna Corporate Finance, Equity Capital Markets och M&A.