Q-linea AB (publ) (”Q-linea” or the ”Company”) announced 6 December the outcome of the offering of new shares in the Company (the “Offering”) and the listing of the Company’s share on Nasdaq Stockholm. The Offering attracted very strong interest from institutional investors as well as the general public in Sweden. The value of the Offering, including the over-allotment option, is SEK 632 million.

The Offering in brief

- The price per share in the Offering was SEK 68, corresponding to a total value of the number of outstanding shares in Q-linea upon completion of the Offering of SEK 1,558 million. Assuming that the Over-allotment Option is exercised in full, the value of the total number of shares in the Company will amount to SEK 1,640 million.

- The Offering comprised 8,088,235 new shares in Q-linea, corresponding to SEK 550 million before transaction costs. The number of shares issued in the Offering corresponds to 35.3 per cent of the outstanding shares in Q-linea after completion of the Offering.

- Assuming that the Over-allotment Option is exercised in full, the Offering will in total comprise a maximum of 9,301,470 new shares in the Company, corresponding to a total value of SEK 632 million, before transaction costs and 38.6 per cent of the total number of shares in the Company after completion of the Offering. After completion of the Offering, assuming that the Over-allotment Option is fully exercised, the total number of shares in the Company will amount to 24,120,150.

- The Offering was substantially oversubscribed and approximately 3,900 investors have been allocated shares in Q-linea. All investors who have applied for acquisition of shares in the Offering to the general public in Sweden have been allocated shares.

- In accordance with their commitments, the current shareholders Investment AB Öresund and The Fourth National Pension Fund have subscribed for a total of 1,323,529 shares for a total of SEK 90 million, corresponding to 5.5 per cent of the shares in the Offering, assuming that the Over-allotment Option is exercised in full. Furthermore, Catella Fondförvaltning AB and Länsförsäkringar Fondförvaltning, who will become new investors in the Company through the Offering, have, in accordance with their commitments, subscribed for a total of 1,323,528 shares for a total of SEK 90 million, corresponding to 5.5 per cent of the shares in the Offering, assuming that the Over-allotment Option is exercised in full. In addition, certain board members and senior executives (among others CEO Jonas Jarvius) of the Company have subscribed for a total of 48,820 shares for a total of SEK 3.3 million, corresponding to 0.20 per cent of the shares in the Offering, assuming that the Over-allotment Option is exercised in full. Jonas Jarvius will after completion of the Offering own a total of approximately 1.56 per cent of the shares in the Company.

- Immediately following the completion of the Offering, assuming that the Over-allotment Option is exercised in full, Q-linea’s largest shareholders will be Nexttobe AB (37.5 per cent of the outstanding shares in the Company), Investment AB Öresund (9.3 per cent) and the Fourth Swedish National Pension Fund (AP4) (6.7 per cent).

- Trading in the Q-linea share on Nasdaq Stockholm commenced 7 December 2018, and the shares will be traded under the ticker “QLINEA”.

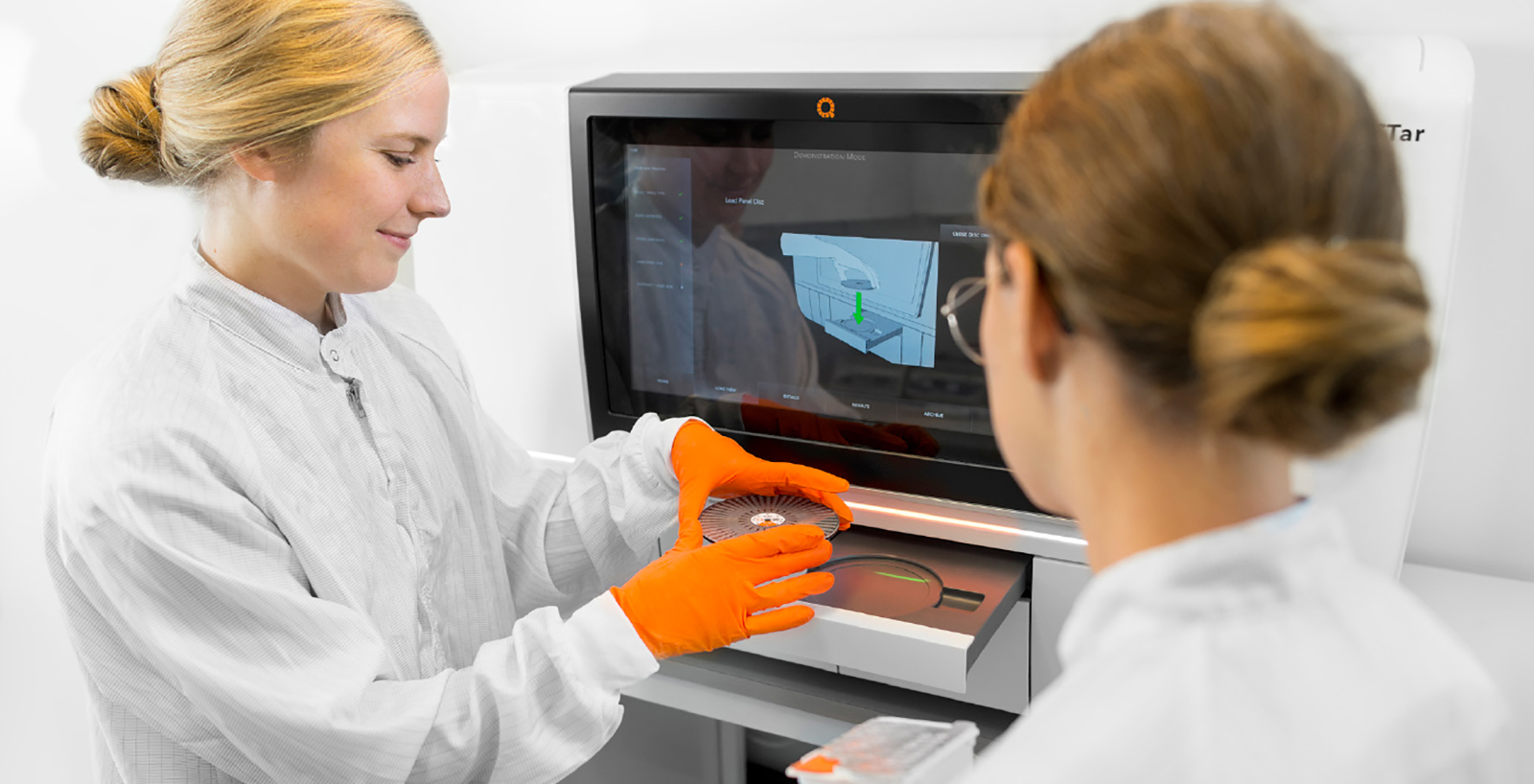

Q-linea is a diagnostic company focused on developing and delivering solutions for healthcare providers, enabling them to accurately diagnose and treat infectious diseases in the shortest possible time.

Carnegie acted as Sole Global Co-ordinator and Sole Bookrunner in the IPO