Qliro AB (“Qliro Financial Services”) has successfully issued subordinated Tier 2 bonds (sw. supplementärkapital) of SEK 100 million with maturity in September 2029 and first possible call date in September 2024. The bonds have a floating rate coupon of 3 month Stibor + 6.75 percent per annum. The transaction received strong interest from Nordic institutional investors. Qliro Financial Services intends to apply for listing of the bonds on Nasdaq Stockholm.

About Qliro Financial Services

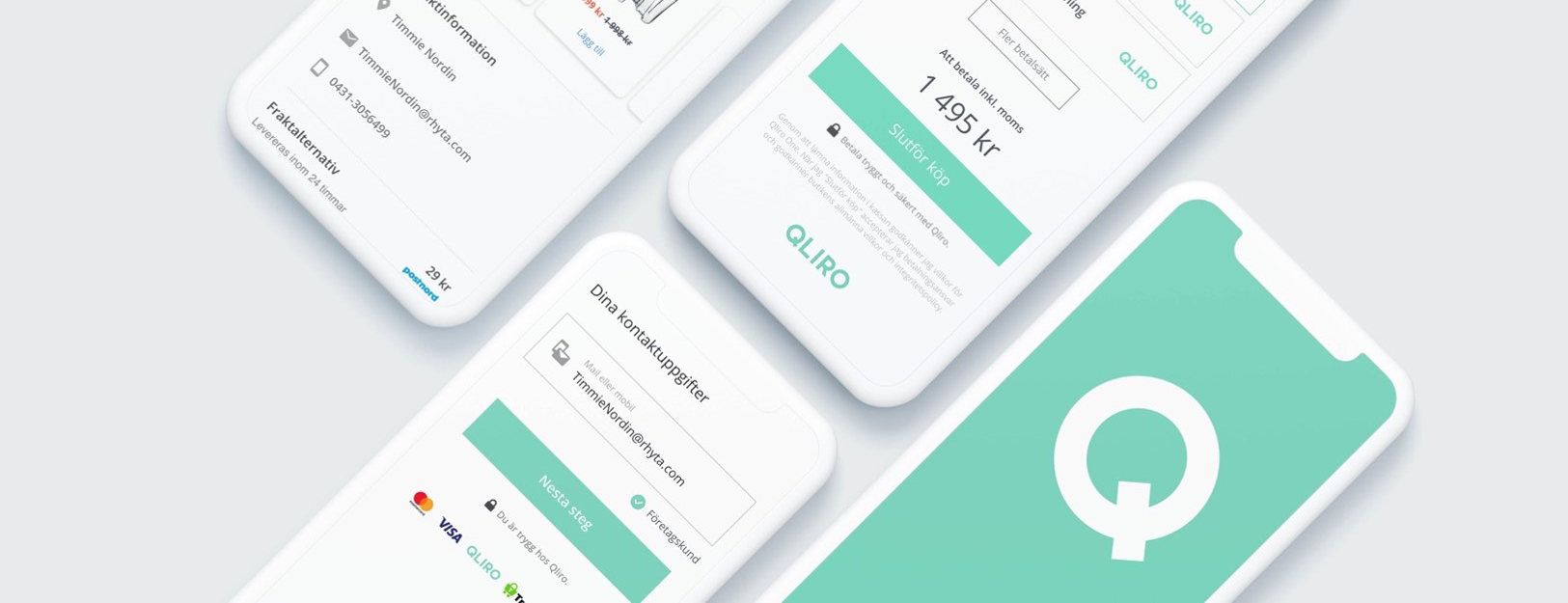

Qliro provides financial services to merchants and consumers. E-merchants are offered a comprehensive check-out solution with the most popular forms of payments such as invoice, partial payment, card and direct bank payments in the Nordics. Consumers are offered several services to simplify their everyday lives, primarily paying safely at their desired pace but also saving and borrowing. Qliro was launched to simplify payments online in 2014. In 2015 the roll-out of the payment solution continued in Sweden and was also introduced in Finland and Denmark. The service is currently used throughout the Nordic region by e-merchants like CDON.COM, Nelly, NLY Man, Gymgrossisten, Lekmer, Tretti, Members, Skånska Byggvaror, Bangerhead and Designtorget.

About Qliro Group

Qliro Group is a leading Nordic e-commerce group in consumer goods and related financial services. Qliro Group operates the leading Nordic marketplace CDON.COM, the online fashion brand Nelly.com and Qliro Financial Services that offers financial services to merchants and consumers. In 2018 the Group had sales of SEK 3.2 billion. Qliro Group’s shares are listed on the Nasdaq Stockholm Mid-Cap segment under the ticker symbol QLRO.

Carnegie acted as sole bookrunner in the transaction.