Klarna Holding AB (“Klarna”) has successfully completed a USD 460 million private placement of new shares targeted to International and Nordic institutional and strategic investors. The funding round was led by Dragoneer Investment Group, a leading San Francisco based growth-oriented investor. Other investors in the private placement include Commonwealth Bank of Australia, HMI Capital LLC, Merian Chrysalis Investment Company Limited, Första AP-Fonden (AP1), IPGL, IVP and funds and accounts managed by BlackRock.

About Klarna

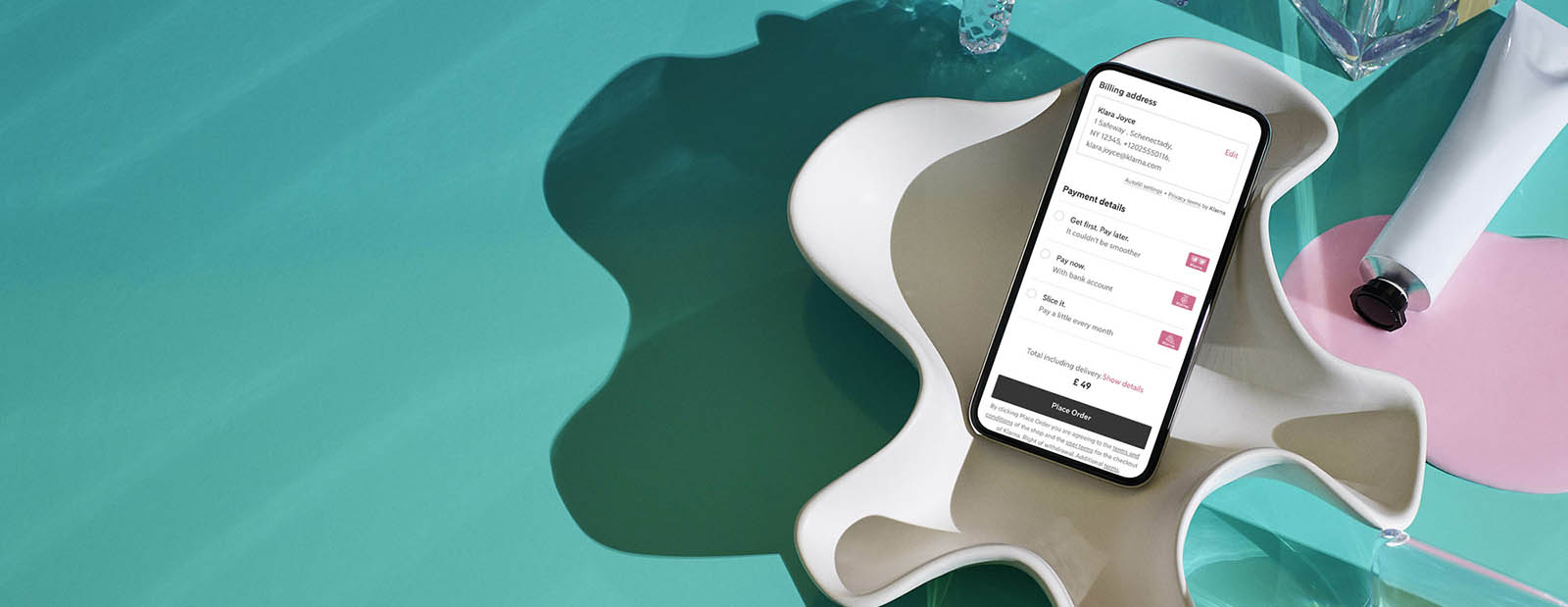

Klarna is leading global payments providers and fully licensed bank, which wants to revolutionise the payment experience for shoppers and merchants alike. Founded in Stockholm, Sweden, in 2005, we give online consumers the option to pay now, pay later or over time – offering a simple, safe and smoooth checkout experience. Klarna now works with 130,000 merchants including H&M, Adidas, IKEA, Expedia Group, ASOS, Pelotan, Abercrombie & Fitch, Michael Kors, Nike, AliExpress, Superdry, Sephora, Spotify, Wayfair, Gymshark, Samsung, Zara, Topshop, The Hut Group, Steve Madden, Boozt, Bugaboo, Rue21, TOMS, Sonos, Agent Provocateur, Lufthansa, ETSY, ACNE Studios, Daniel Wellington, KLM, Turkish Airlines and many more. Klarna has 2,500 employees and is active in 14 countries.

Carnegie acted as Nordic advisor to Klarna in relation to the Nordic investors participating in the process.