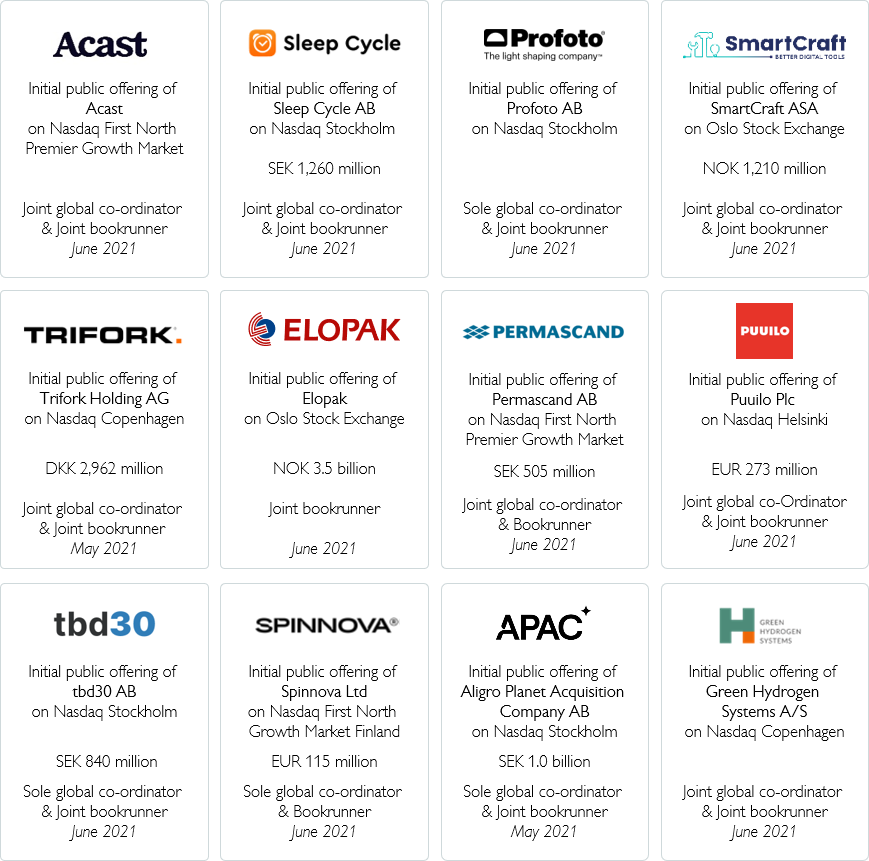

After a highly successful 2020, Carnegie has broken records and achieved its best six months ever, having helped its clients raise a total of over USD 7 billion in 34 IPOs thus far in 2021.

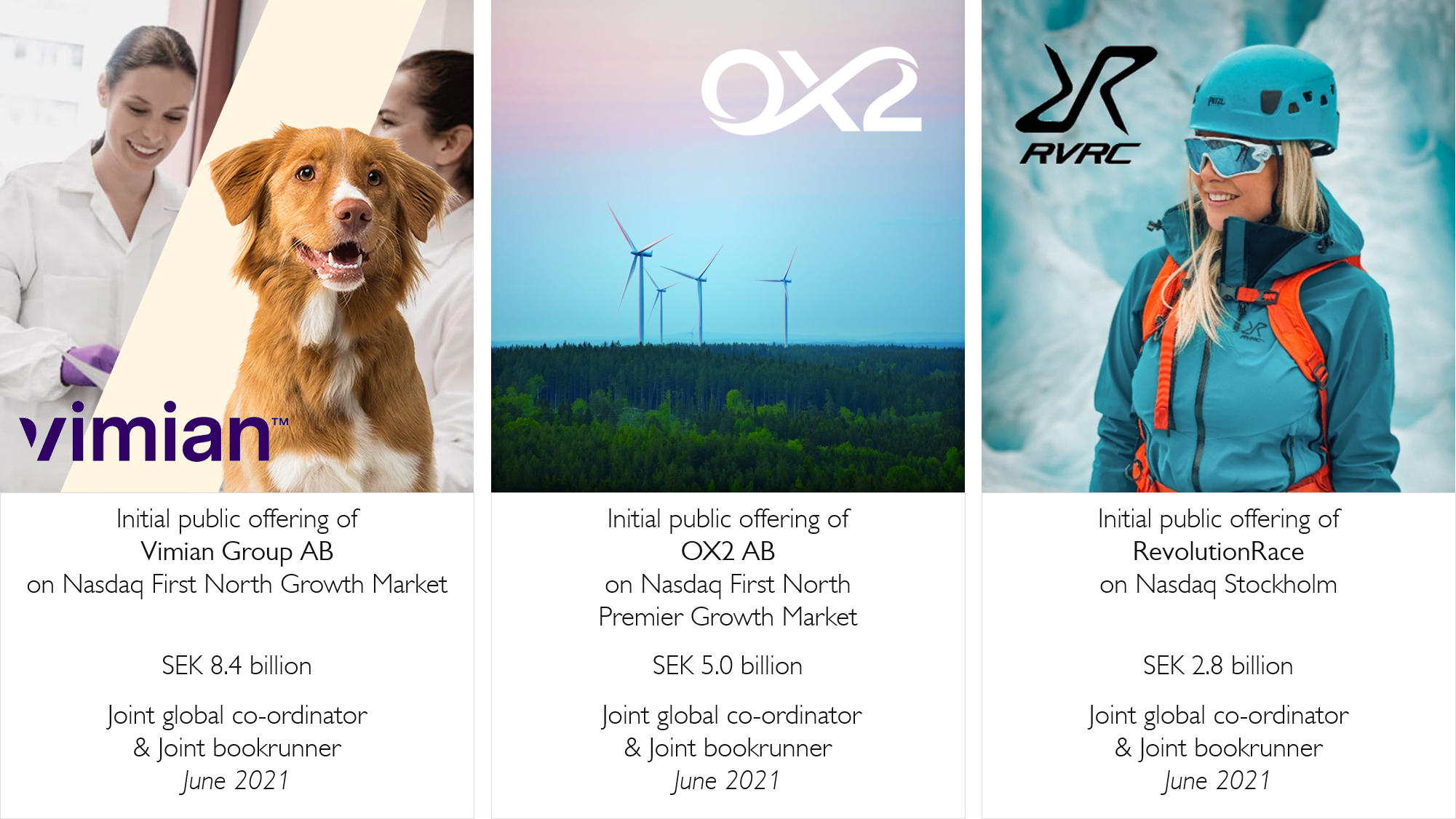

Recent 2021 IPOs include the SEK 8.4 billion IPO of Fidelio-backed animal healthcare company Vimian, SEK 5.0 billion IPO of the renewables developer OX2 and SEK 2.8 billion IPO of the outdoor apparel company RevolutionRace. Each of the IPOs attracted strong interest from investors and was significantly oversubscribed.

SEK 8.4 billion Vimian IPO

Carnegie was Joint Global Co-ordinator and Joint Bookrunner in the IPO of Vimian on Nasdaq First North Growth Market on the 18th June 2021. Vimian is a global, fast-growing, and innovation-driven animal health business, offering products, services and solutions to veterinary professionals, labs, and pet parents around the world. The price per share was set to SEK 76, corresponding to a post-money equity valuation of approximately SEK 29.6 billion equal to an EV/EBIT 21E multiple of 49x. Cornerstone investors, including SEB Investment Management AB, Swedbank Robur Fonder and Cliens Kapitalförvaltning AB, acquired shares in the offering corresponding to an amount of approximately SEK 5.1 billion.

SEK 5.0 billion OX2 IPO

Carnegie acted as Joint Global Co-ordinator and Joint Bookrunner in the IPO of OX2 on Nasdaq First North Premier Growth Market on the 23rd June 2021. OX2 is a leading European renewables developer. The price per share was set to SEK 60, corresponding to a market value of approximately SEK 16.4 billion and an EV/EBIT 21E multiple of 44x. As a result of the offering, OX2 will have more than 25,000 shareholders. Cornerstone investors, including Afa Försäkring, BNP Paribas Energy Transition Fund and Danica Pension, acquired shares in the offering corresponding to an amount of approximately SEK 2.3 billion.

SEK 2.8 billion RevolutionRace IPO

Carnegie was Joint Global Co-ordinator and Joint Bookrunner in the IPO of RevolutionRace on Nasdaq Stockholm on the 16th June 2021. RevolutionRace is a profitable and rapidly growing company that offers high-quality outdoor apparel for an active lifestyle to a global and wide customer base through a D2C model. The price per share in the offering was set to SEK 75, corresponding to a market value of approximately SEK 8.5 billion and an EV/EBIT 21E multiple of 29x. Cornerstone investors, including BlackRock Inc, Capital World Investors and Handelsbanken Fonder AB, acquired shares in the offering corresponding to an amount of approximately SEK 1.4 billion.

Carnegie has been the advisor of choice for a number of recent American-style Special Purpose Acquisition Vehicles, including APAC which listed on Nasdaq Stockholm on 26th May and the business services-focused special purpose acquisition company, TBD30, which commenced trading on Thursday 24th June.

Carnegie’s H2 IPO pipeline is strong and we expect the high transaction activity in all our product groups including M&A, DCM and Private Placements to continue to thrive.

Tony Elofsson, Head of Investment Banking Sweden

Commenting on the Swedish IPO market, Tony Elofsson reflected:

‘We are truly humbled to have advised so many inspiring and successful companies on their initial public offerings to the Nordic stock market. The Swedish stock market, in particular, is one of Europe’s best performers and Carnegie has raised a total of USD 4.8 billion for Swedish companies so far this year, which is the most IPO proceeds since the first six months of 2000. Carnegie’s H2 IPO pipeline is strong and we expect the high transaction activity in all our product groups including M&A, DCM and Private Placements to continue to thrive.’

Selected other IPO’s completed by Carnegie in the last month: